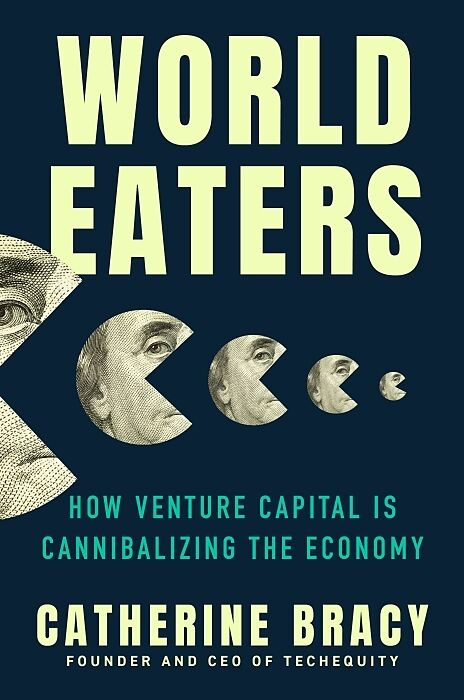

World Eaters

Beschreibung

An urgent and illuminating perspective that offers a window into how the most pernicious aspects of the venture capital ethos is reaching all areas of our lives, into everything from healthcare to food to entertainment to the labor market and leaving a trail o...Format auswählen

- Fester EinbandCHF 42.40

Wird oft zusammen gekauft

Andere Kunden kauften auch

Beschreibung

An urgent and illuminating perspective that offers a window into how the most pernicious aspects of the venture capital ethos is reaching all areas of our lives, into everything from healthcare to food to entertainment to the labor market and leaving a trail of destruction in its wake.

The venture capital playbook is causing unique harms to society. And in <World Eaters<, Catherine Bracy offers a window into the pernicious aspects of VC and shows us how its bad practices are bleeding into all industries, undermining the labor and housing markets and posing unique dangers to the economy at large. VC’s creates a wide, powerful wake that impacts the average consumer just as much as it does investors and entrepreneurs.

In researching this book, Bracy has interviewed founders, fund managers, contract and temp workers in the gig economy, and Limited Partners across the landscape. She learned that the current VC model is not a good fit for the majority of start-ups, and yet, there are too few options for early stage funding outside of VC dollars. And while there are some alternative paths for sustainable, responsible growth, without the help of regulators, there is not much motivation to drive investors from the roulette table that is venture capital.

<World Eaters <is an eye-opening account of the ways that the values of contemporary venture capital hurt founders, consumers, and the market. Bracy’s clear-eyed debut is a must-read for fans of <Winners Take All<, <Super Pumped<, and

Autorentext

Catherine Bracy is a civic technologist and community organizer whose work focuses on the intersection of technology and political and economic inequality. She is the Founder and CEO of TechEquity, was previously Code for America’s senior director of Partnerships and Ecosystem, and founded Code for All. During the 2012 election cycle she was director of Obama for America’s Technology Field Office in San Francisco, the first of its kind in American political history. She is a prolific public speaker for places like Axios and the Personal Democracy Forum. Her TED Talk “Why Good Hackers Make Good Citizens” has almost one million views. Her work has been highlighted in the LA Times, New York Times, and NPR.

Klappentext

**Longlisted for the Non-Obvious Book Award 2025

A Next Big Idea Book Club March 2025 Must-Read

An urgent and illuminating perspective that offers a window into how the most pernicious aspects of the venture capital ethos is reaching all areas of our lives, into everything from healthcare to food to entertainment to the labor market and leaving a trail of destruction in its wake.

*

The venture capital playbook is causing unique harms to society. And in World Eaters*, Catherine Bracy offers a window into the pernicious aspects of VC and shows us how its bad practices are bleeding into all industries, undermining the labor and housing markets and posing unique dangers to the economy at large. VC’s creates a wide, powerful wake that impacts the average consumer just as much as it does investors and entrepreneurs.

In researching this book, Bracy has interviewed founders, fund managers, contract and temp workers in the gig economy, and Limited Partners across the landscape. She learned that the current VC model is not a good fit for the majority of start-ups, and yet, there are too few options for early stage funding outside of VC dollars. And while there are some alternative paths for sustainable, responsible growth, without the help of regulators, there is not much motivation to drive investors from the roulette table that is venture capital.

World Eaters is an eye-opening account of the ways that the values of contemporary venture capital hurt founders, consumers, and the market. Bracy’s clear-eyed debut is a must-read for fans of Winners Take All, Super Pumped, and Brotopia, an appealing “insider / outsider” perspective on Silicon Valley, and those who are fascinated to look under the hood and learn why the modern economy is not working for most of us.

Leseprobe

1

THE METHODOLOGY

HOW VENTURE

CAPITALISTS THINK

"Venture capital is not even a home run business.

It's a grand slam business."

-Bill Gurley, investor, Benchmark Capital

Over time, venture capital has come to be governed by a law of nature known as the power law. The power law is a naturally occurring phenomenon defined by the distribution of values within a certain type of dataset. Unlike in a normally distributed dataset, where most of the values are clustered around the average, in power law distributed sets, a tiny number of outliers can drag the average up all by themselves. Power law distributions have long tails, representing a large number of small values and a small number of very large values.

Power laws can be observed in almost every corner of nature and society. The intensity of earthquakes, for example, is power law distributed. Most earthquakes, which occur with much more frequency than humans ever notice, don't even register on the Richter scale. But a small handful result in disastrous outcomes, leveling cities and defining how scientists relate to the phenomenon. Human populations are distributed according to a power law. Most people live in a tiny handful of very large cities, with the rest of the earth's population spread among many more smaller locales. Activity on the internet tends to be power law distributed too: a small number of sites on the web account for the majority of its traffic.

Venture capital funds, it turns out, also appear to be power law distributed. Venture capital funds are made up of a collection of companies, called a portfolio, usually a few dozen or so per fund. These companies are in early stages of development, and as such, there is much more uncertainty about their prospects. Unlike the companies funded by private equity, venture capital's more mature and boring older brother, the startups in a venture capital portfolio are, at least in theory, doing something interesting and innovative, often employing new technologies if not creating them. These characteristics lend themselves to a dynamic where there are lots of companies that fail to deliver on their vision but also a handful of world-changing breakthroughs that create enormous value. This end result, when these companies are compiled into a portfolio, is an overall fund value that is quite lucrative, even though only a small fraction of the companies within the fund are driving most of the value creation.

The relationship between the power law and venture capital has evolved over many decades, and in fact, as Tom Nicholas points out in his seminal history of venture capital, VC: An American History, has its roots in a much older industry. Whaling in nineteenth-century New England was, much as the tech industry is today, both highly lucrative and highly risky. Investors understood that if a whaling vessel had a successful venture, it could make them a huge return in exchange for a relatively small chunk of up-front capital. This was a big if. Whaling was highly unpredictable and very dangerous. It could take years for them to return, if they returned at all (many of them were lost at sea), and there was no guarantee that even if they did return, they would do so with a big enough catch to turn a profit. And yet, when they did succeed, they tended to succeed big.

Soon enough, savvy middlemen emerged who realized that if you spread around investors' money to multiple ventures, the chances of making a profit were much improved. If you aligned the incentives of the investors and the ship's crew by compensating the crew with a cut of the ship's haul instead of a regular salary, the chances of success went up even further. You could improve your odds even more by making bigge…